7 Best Budget Trackers for Paper Lovers

I hate budgeting just as much as the next shopaholic, but I’ve learned it’s really important to honestly and consistently budget. It’s really the only way to make sure I have enough money to eat at the end of the month.

Instead of budgeting on loose pieces of paper and sticky notes like I used to, it’s best to have an actual notebook dedicated to budgeting—or at the very least a planner with a built-in budgeting section. If you want to be financially responsible and literate, I recommend choosing one of the following budget trackers.

ClassTracker Be Your Best You Notebooks

![]()

ClassTracker Be Your Best You Notebooks, $10.99 at ClassTracker

In general, tracking budgets is overwhelming, especially for those new to the process—and sometimes budget trackers can make the experience seem even more daunting. The Be Your Best You Budget notebook from ClassTracker, however, is a great tool for budget newbies and those who prefer a more simple approach.

This little notebook has 13 monthly charts for tracking your expenses. There are eight slots for different expenses, and four of those are labeled with “food,” “entertainment,” “transportation,” and “personal care.” Each day of the month you write down how much you spent on those various items, and at the end of the month you add up the totals so you can see just how even or unbalanced your spending is. There are also boxes at the bottom of each month for your monthly expenses, including rent/utilities, insurance, books/supplies, tuition/fees, cell phone, and three other blank boxes.

It’s clean, to-the-point, and a great way to see and analyze your spending.

Erin Condren Monthly Budget Book

After using this budget book, I highly recommend it to every single 20-something fresh out of school. Actually, I think even college-age students could benefit from it. The Erin Condren Monthly Budget Book breaks everything down—and I do mean everything. The practice of writing down your expected income and your expenses is good for learning what it really means to budget.

Erin Condren Budget Book, $12 at ErinCondren.com

Warning though: It will make you feel shame for any senseless spending. Within 20 minutes of writing in the month of May, I wanted to scold myself for the $9-worth of ATM fees and $130 spent eating out. However, it’s the exact kind of rude awakening I needed, and I’ll now be much more aware of when and how I’m spending my very limited, very precious dollars.

Each month has an entire page with every category broken down, plus room for you to write in your own categories. The boxes are small because the notebook is small, but that’s the price you pay for a portable budget book. I’ve already run into the issue of needing to add on more money to certain sections, but with teeny-tiny handwriting and some whiteout, I can keep it all updated and under control. There’s also a monthly saving goal page at the start of the notebook. Having this page first is a subtle reminder that saving should come first. There’s a slot for your saving goal and then the actual deposit you make. Simple, but to the point.

The Monthly Budget Book ends with a contacts page, passwords page, and a debt management tracker, which is like the savings goal page. In the Debt Management Tracker, you write down your starting balance including all debts, the debt being paid off, how much you owe, your payment, the date, the new balance, and the remaining balance. You can use this page to track the payments you’re making on multiple debts, and the layout shows you visually how you’re dividing your debt payments among them.

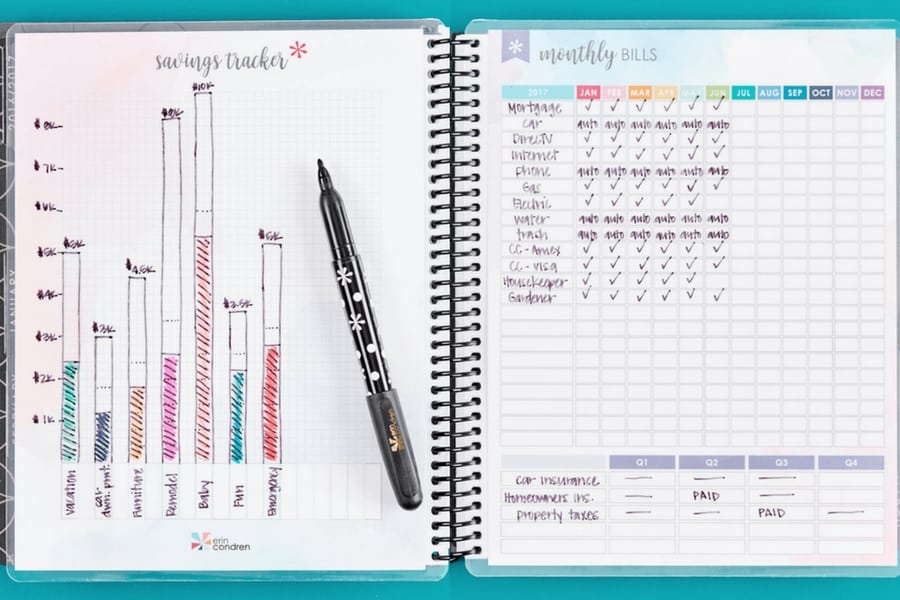

Bonus Erin Condren Option: Monthly Bill Tracker Dashboard

Snap-In Monthly Bill Tracker Dashboard, $6 on ErinCondren.com

Well, this may not exactly be made of paper, but the Monthly Bill Tracker dashboard from Erin Condren does work perfectly in tandem with your Monthly Planner or LifePlanner from Erin Condren. This dashboard provides you with a useful chart to track up to 22 monthly bills and their amounts every month of the year. You can use the quarterly section on the bottom to track quarterly bills, and the entire backside of the dashboard is for tracking your savings. The graph on the back allows you to monitor your progress for multiple things should you need in many different ways. You can use bar graphs to track your savings growth for multiple accounts and events, or you can make a line graph to track the growth of just one. The best part? You can wipe it all clean and start over if you want to.

XO Planners’ Monthly Finance Pages

Image via XO Planners

XO Planner, $50 at XOPlanners.com

The monthly budgeting pages in XO planners is simple and effective. It includes space for you to log your total income, savings, expenses, and even debt. There’s also a chart for you to log all of your planned expenses (bills) and when they’re due.

There’s also a space for you to write down your financial goals and priorities, which is incredibly important. Your financial priorities, like rent and dog food, have to always come before your goals, like saving $200 extra bucks. Unfortunately, it tends to be easy to forget to think of those priorities when also setting your goals. That’s why it’s so awesome that XO Planners included it in the financial pages.

Another huge part of the budget planning here are the two columns for you use to write down the things you want to purchase and the things you need to purchase. This distinction tends to end up the same way as financial priorities, so it’s very beneficial to have that monthly reminder to differentiate your shopping list. I know that thinking of a purchase through the lens of want vs. need makes all the difference in how I spend. Plus, it helps you stay within budget.

Ashley Shelly’s Budget Notebook

Ashley Shelly Budget Notebook, $13 at AshleyShelly.com

For some, budgeting needs to include a little more than tracking expenses and bill due dates. The Budget Notebook from Ashley Shelly provides the standard expense and bill tracking, but it also provides pages for savings management, debt repayment, and financial goals. There are pages to write down all of your bills, their amounts, and their due dates in organized sections so you can stay on top of your bill schedule each month.

If you’re concerned with your savings account (and you should be) you can use the savings pages to keep track of how much money you add to the account, how you remove from the account, and the dates. The expense tracking pages that make up the majority of Ashley Shelly’s Budget Notebook are a little different than other budgets. It’s a two-page layout that you can use to track expenses on a daily or weekly basis — whichever way works best for you.

One entire page is dedicated to notes for you to write down financial goals and thoughts as they come to you. At the very back there’s a section devoted entirely to your debts. Here you can log the amounts you owe, the interest rates, and your payment plan amounts, in addition to tracking your debt payment so you know exactly how much you have left. It’s a great planning tool for those who want to budget in addition to focusing on their savings, debt repayment, and financial goals.

Start Planner Hustle Weekly Planner

STARTplanner Hustle Weekly Planner, $60 at StartPlanner.com

This isn’t just a financial planner; Start Planner’s Midyear Hustle Weekly Planner has a great monthly budget section compared to most regular planners. In the monthly page, there’s a section for you to write down your financial goals for the month, your projected income and expenses, your weekly financial goals, as well as your actual total by the end of the month.

It’s not super detailed, but it hits the highlights and provides a space for you to map out your budget in terms of income, expenses and savings. And that’s the important stuff. Most of us do a monthly budget broken down into our planned spending anyway, so this can be the exact tool you need. It beats the hell out of jotting it all down into the margins of your planner or on post-it notes (guilty!).

The added weekly goals breakdown is particularly useful. This helps you think of your spending by the week, which is crucial when you’re budgeting for things like gas and food and social events. It’s easy to forget about those survival expenses and random things that come up throughout the week when budgeting at the beginning of the month. It’s also easy to overlook those expenses when you look back over the month to see how well you’ve done.

Common Cents

We might be just a *little* bit biased, but our new budgeting workbook, Common Cents, is the most comprehensive budget tracker in the game. Not only did we include 12 budgeting worksheets (one for each month of the year, although they’re undated in case you fall off and back on the wagon), but there’s also room to plan out your purchases, set financial goals, create a debt repayment plan, and build up your savings. This budgeting workbook is perfect for both budgeting beginners AND pros!

Common Cents is available now!

Follow Terra on Instagram: @terrabrown3

Last modified on February 4th, 2019

Show Comments +