6 Best Apps for Budgeting

If you’re constantly tight on cash, downloading one of these apps for budgeting could help solve your money problems. You’re probably sick of hearing the word “budget,” but until money starts growing on trees it’s your only option. It can be quite difficult — or even impossible — to get a raise, but it’s a lot easier to learn how to save.

This is true in good times and bad. Even if you’re not currently suffering from money problems, developing the right habits now can help you survive tough economies and tight situations in the future. You never know when an emergency will hit, and having some extra cash stashed away will help you get through it.

A budget also helps you figure out your long-term goals by giving you a map for working towards them. Having a financial plan helps you to see an overall picture of your finances so that you can reach your goals more expediently. But if starting a budget seems overwhelming, just know you don’t have to do it alone. There are several mobile apps for budgeting that can help you stay on top of your finances with just a few clicks on your smartphone.

HomeBudget with Sync

Available on iPhone/iPad, Android, and desktop

HomeBudget is an intuitive, user-friendly app which is quite easy to set up. This app is perfect if you live with your significant other and share finances because it syncs your budget in the cloud with multiple users to ensure you are always on the same page. Your categories for spending include Internet, phone, groceries, emergency funds, car insurance, rainy day funds, and more.

HomeBudget uses your salary as a starting point for tracking your expenses. Then, you can see what you have available in addition to reports such as where most of your money is spent. That way, if you need to modify any of your spending habits such as your $100/month Starbucks habit, you can.

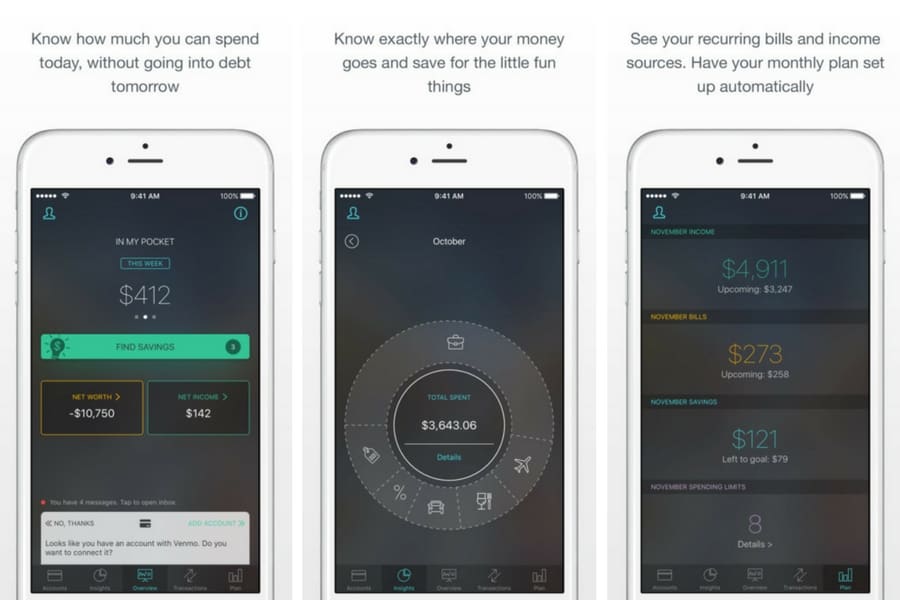

YNAB

Available on iPhone, Android, iPad, Apple Watch, Alexa, and desktop

YNAB stands for You Need a Budget. This app says it will give you “total control” over your finances. However, you will need to use it with the YNAB software, which costs $60. The company says when you use this app, you’ll stop overdrafting, will pay off your credit card debt and achieve financial peace. You can quickly enter transactions and check your category budget before spending. Additionally, you can easily move money between categories.

Mint

Available on iPhone/iPad and Android

Mint has both mobile and desktop interfaces that allow you to see everything in one place such as your balances, bills, and credit score in a way that’s easy to navigate and understand. All you have to do is link your bills and credit cards. From there, you can track your investments, create budgets, and look for new ways to save more.

The point is to spend according to your priorities. This can be easy to forget when you’re out and about, and tempted to spend your money on things you don’t need. You might not even realize you spend $80 per month on frappuccinos. But if you actually see where your money is going, it can be much easier to break the habit and instead put that money away for rainy day savings or retirement. Mint helps you to decipher and organize your spending to improve your overall financial health.

LearnVest

Available on iPhone and Android

LearnVest is a dedicated financial planner that gives you a customized financial plan. Sometimes you need to navigate the gray area between black and white, which is why LearnVest also pairs you with a real person who can help you take on difficult financial decisions. All of their financial planners are Certified Financial Planner™ professionals or Investment Advisor Representatives (FINRA Series 65).

You’ll get a snapshot of your financial life, then you will set goals and create action steps. You’ll also have small to-dos to help build your confidence and willpower when it comes to budgeting your money. You can then eliminate debt and start to build wealth. With LearnVest, you’ll get the help you need to redirect your funds towards savings and investments to help actively generate income from items such as capital gains.

PocketGuard

Available on iPhone and Android

PocketGuard is an all-in-one bank account tracking and budgeting app where you can connect both your bank and credit card accounts. The app then instantly sorts your purchases, bill payments, subscriptions, and more. It shows how much money you have in all of your accounts, as well as how much you can afford to spend that day.

Wally

Available on iPhone and Android

You can use Wally to set a savings target, spending budget and your income. You can then quickly reference your finances on the main screen. It also offers social and location tools for your expenses which not only tell you how much you spend but also who you were with and where. In addition, you can get a snapshot of your spending habits with detailed infographics. Selected accounts can be shared with anyone who needs to know your budget.

Ryan Stewart is a digital marketing leader with over 8 years of experience working to help Fortune 500 brands grow their online presence. He currently resides in Miami, where he operates the boutique creative agency, WEBRIS. You can find Ryan on Twitter or LinkedIn.

Last modified on August 31st, 2018

Show Comments +